There are 7 New Zealand Dollar NZD pairs that can be easily traded by forex traders. Forex traders continue to overlook NZD trading and these pairs, but they present great opportunities to make pips. These pairs include the NZD/USD, NZD/JPY, NZDCAD, NZD/CHF, EUR/NZD, GBP/NZD and AUD/NZD. Seven NZD pairs total.

New Zealand Dollar NZD Pairs Characteristics

The most popular pair that forex traders trade is the EUR/USD. Many of the New Zealand Dollar NZD pairs have characteristics that are are much better for trading than the EUR/USD. We trade 28 pairs total in the Forexearlywarning trading system, including all seven NZD pairs.

The NZD pairs offer a wide variety of characteristics, like low volatility to high volatility, and can be traded in the Asian trading session or the main trading session. From the standpoint of market trading hours, any trader in the world can trade these pairs throughout the trading week.

The volatility characteristics of the New Zealand dollar pairs can be a great benefit to traders. Take the EUR/NZD for example. When this pair is moving in the main trading session the volatility is beneficial as this pair moves much faster than more popular pairs like the EUR/USD. This allows traders to take profits and move stops to breakeven faster. And the GBP/NZD is suitable for traders who have experience trading volatile instruments, volatile stocks or low float stocks with high volatility. Traders who are looking for volatility will love trading the GBP/NZD.

The spreads on the NZD pairs are reasonable from most forex brokers for all of the NZD pairs during the main trading session. However on some pairs like the AUD/NZD or GBP/NZD you may have to check with more than one broker as spreads on these pairs are higher. Being aware of the most of the currency pair characteristics of the pairs you are trading will open the door to many more pairs and more pip potential.

When To Trade The New Zealand Dollar NZD Pairs

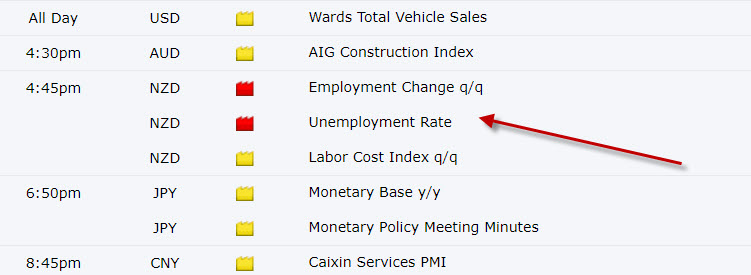

The New Zealand Dollar NZD pairs can be traded during the best times to trade the forex market, during both sessions. The Asian trading session and the main forex trading session. You can check the forex news calendar and you will see that the NZD news drivers occur frequently in the Asian trading session and drive movement on these pairs. All currencies can move in the main trading session. This is an advantage over trading the EUR/USD, which only moves on the main session. Surprising but true as most traders continue to focus on just one pair.

How To Set Up Trend Indicators for Monitoring the New Zealand Dollar NZD Pairs

Lets look at the best way to set up your trend indicators for trading the New Zealand Dollar NZD pairs. Traders can start with our free forex trend indicators, which is a system of exponential moving averages for tracking individual currencies.

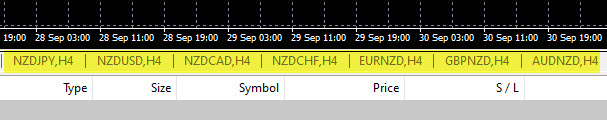

The next thing you would like to do is set up all 7 New Zealand Dollar NZD pairs together in a group, side by side. This makes it much easier for traders to see if the NZD is consistently weak or strong. For example if all of the pairs with the NZD as the base currency NZD/ are trending up, and all of the pairs with the NZD as the cross currency /NZD are trending down. The NZD is strong and you should be trading in that direction. This is called forex analysis using parallel and inverse pairs, and is by far the best analytical method available to forex traders.

Grouping the New Zealand Dollar NZD pairs together allows trader to see if a valid trade is possible and to check if the NZD is consistently strong or weak.

How To Enter Trades on the New Zealand Dollar NZD Pairs

Now we will present some rules for entering trades on the New Zealand Dollar NZD pairs. First, check the trends on the larger time frames like, H4, D1 and W1 on the NZD pairs. If a good trend is in place or developing on the higher time frames, then that pair is a candidate for a trade.

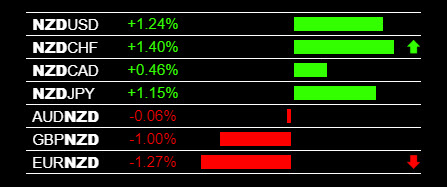

Then set an audible forex price alert on the smaller time frames so that you can be notified of any breakouts to intercept the next movement. When the price alerts hit check The Forex Heatmap® forex heatmap for consistent NZD strength or weakness to confirm the entry. Make sure the price target is at least 100 pips away to preserve risk to reward ratio for each trade. Along with audible price alerts, we also have other other professional forex alert systems to notify traders when the forex market is moving.

See the example trade above. On this trading day the EUR/NZD dropped 250 pips. Other trades like buying the NZD/USD were possible on the same day, based on the NZD strength in the market. Hundreds of pips of movement across the NZD currency pairs occurred on this day. If the EUR/NZD is in a downtrend, or if the NZD/USD is in an uptrend, even more pips are possible going forward, along with these strong intraday movements.

Most forex traders never look at trades like this due to their using technical indicators and following only one pair, the EUR/USD. If traders are able to change their thinking and start to follow groups of pairs and setting up these indicators, traders can increase pip totals substantially.

Summary and Conclusions: Forex traders should follow the New Zealand Dollar NZD pairs and trade them. These pairs are overlooked by most traders, but these pairs have great characteristics and high potential to make pips. We have provided traders with the best possible setup of indicators in this article for success trading these pairs. The methods and indicators you see in this article also work for a total of 8 currencies and 28 pairs.