In this article we will explain to forex traders how the spread is calculated on the most liquid and commonly traded currency pairs. This will give traders a better understanding of market structure and market participants. We will also explain why the bid/ask spread varies throughout the day.

What Is The Spread

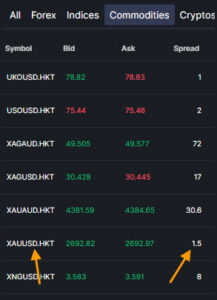

The spread is the difference between the bid price and the ask price.

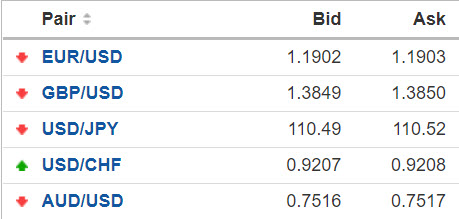

Look at the example above. You can see that the spread for the EUR/USD is 1 pip, but the spread for the USD/JPY is 3 pips. To calculate the spread, subtract the bid price from the ask price, the difference is the spread. For the USD/JPY 110.52 – 110.49 = 0.03 which is 3 pips. This is the transaction cost to the trader of executing the buy or sell trade when you buy or sell the USD/JPY with this particular broker.

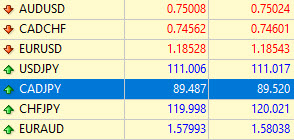

In recent years the spreads have been tightening on the top 8 most liquid currencies. Traders should be able to trade the top 28 pairs comprised of these 8 currencies without any problem. Due to increased liquidity and trading volumes on most forex pairs, you will now see most spreads expressed with an extra significant digit, 5 not 4. The spreads will be shown in tenths or 1/10 of a pip.

Look at the CAD/JPY bid and ask spread in the example above. The spread is expressed as 3.3 pips. 89.520 – 89.487.

Bid Price And Ask Price

When a trader conducts a trade, they always buy at the ask and sell at the bid price, like at a live auction. The bid price is the highest price that all current market participants are willing to pay for a currency pair. The ask price is the lowest price rate at which the real time are willing to accept to sell the same currency pair. The difference is the spread, and in real time these are called “spot” prices.

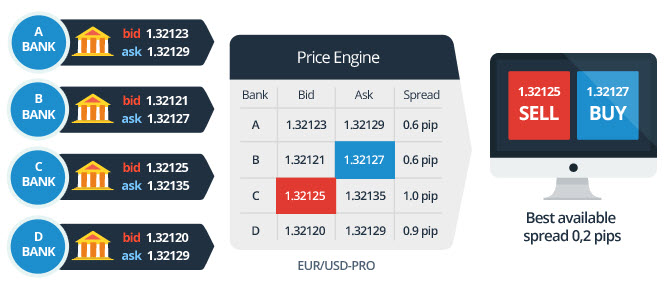

In the example above the Bank A and Bank B, etc. might not be banks. They could be anybody, like a retail forex trader with a few mini lots, a broker or other dealer, a liquidity provider, or it could be a bank too. All market participants, small or large, are side by side. The highest bid and lowest offer is what creates the spread.

An ECN broker allows all market participants, big or small to find a counterparty for their buy or sell order and trading positions. Small retail investors are trading side by side with larger institutions. No conflict of interest. Bid and Ask quotes are created by the market, not the broker. All of the retail traders and liquidity providers are in the same electronic market side by side and the spread is created by the highest bid and the lowest offer from all participants. The role of the broker is strictly an intermediary between the individual trader and all other market participants.

With an ECN the spread will vary throughout the trading day. So retail traders remember this: a market order is not the bid or ask price you see, it is the next available price. The price you get may or may not be the same as what you see when you place your buy or sell order. Traders can use limit orders if they want to specify their prices.

Fixed Versus Variable Spread

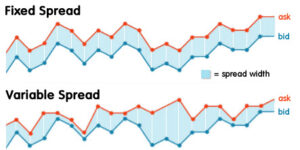

The type of spreads that you’ll see on a trading platform depends on the forex broker and how they make money. There are two types of spreads, fixed and variable or floating. Fixed spreads are usually offered by brokers that operate as a market maker or “dealing desk” model while variable spreads are offered by brokers operating a “non-dealing desk” model.

The choice between fixed and variable spreads depends on your trading style, risk tolerance, and market experience. It’s crucial to understand the characteristics of each type of spread.

What Does The Spread Indicate

The spread on the spot forex market indicates two different things. The pair with the lowest spread is the EUR/USD. This is because the Euro and the US Dollar are the two most liquid currencies, so when combined they create a pair with the lowest spread. So the spread is an indicator of liquidity and trading volume. The lower the spread the higher the liquidity and popularity of that pair.

But spreads on the spot forex are not constant throughout the day. In the main trading session the spreads are always the lowest, and this is likely the best time to trade the forex market. Outside of the main trading session spreads will widen due to lower number of market participants. So spreads will vary based on time of day.