Any forex trader can quickly learn to locate the trends of the forex market with some easy to set up moving averages. Trading forex trends on the larger time frames will ensure that traders always have a good level of success by not going against the market. Applying some filters like support and resistance will help traders to locate a profitable entry point into the market trends across 28 pairs and 8 currencies.

Benefits Of Trading Forex Trends

The benefits of trading forex trends are numerous. The forex market is a trending market. Most trend cycles tend to last for several days and can go on for weeks and some times months. Getting into a trend and riding the trend, letting the trend do most of the work is a sharp contrast to trying to scalp 10 pips every day using technical indicators. Trading forex trends on the higher time frames, H4 and larger, will result in less trades and more potential pips per trade. Even novice forex traders know that the pips are in the larger time frame trends, they just need to adjust their style to capture more pips. Any trader can inspect trend cycles on the H4 time frame or larger over time to prove to themselves that trend trading is the place to be.

Set Up The Moving Averages

The first thing a trader needs to do is to set up their trend indicators. In order to locate the trends on the forex market you should first set up some moving averages. These free forex indicators are not complicated to set up or interpret. These are some basic exponential moving averages with two colors, green for the 5 period and red for the 12 period. You can set up these trend indicators up on almost any forex charting platform. Some of the images you see in this article will show you how the trend indicators look on a Metatrader platform. The trend indicators can be set up on any group of pairs you wish, including the 28 pairs comprised of the eight major currencies we follow on a day to day basis. The eight major currencies are the USD, CAD, EUR, CHF, GBP, JPY, AUD and NZD.

Locate the Trend

Now that we have a set of trend indicators, we can work on locating any exiting trends. When looking for trends always start with the largest time frames like the MN and W1 time frames and work backwards through the smaller time frames. Drilling down the charts and trends this way is called multiple time frame analysis. Multiple time frame analysis can be learned by any forex trader and is a powerful technique for market analysis.

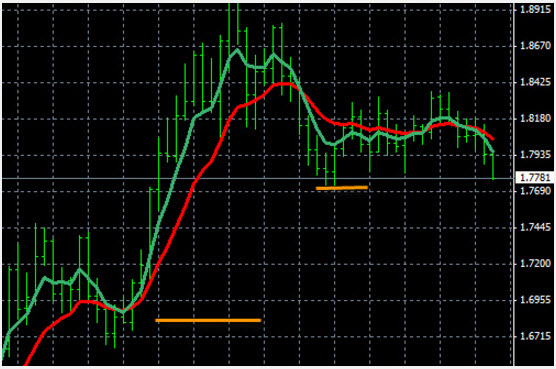

If you find strong uptrends or down trends with the larger time frames, this is good news for any trader who intends to always be trading forex trends. For a pair that is trending up the red and green lines on the moving averages will be pointing up and separated, for a pair that is trending down the moving averages will be pointing down and separated on that particular time frame. See the image below for an example trend.

If a trader also sets up the moving averages by individual currency they can start to make more pips much faster. Set up your moving averages grouped together with one common currency. For example, if you set up all of the EUR pairs together, it will be much easier to spot EUR strength or weakness in the market. For example, if all of the D1 time frames are pointing up on the EUR pairs, you know the EUR is strong and can be traded in that direction. This also allows pairs like the EUR/CHF, EUR/CAD and EUR/JPY, plus other EUR pairs, to be considered for trading. If you would like to determine individual currency strength for 8 currencies, check out our forex market analysis spreadsheet.

Filter Potential Trades With Support and Resistance

The experience of trading forex trends can be enhanced by filtering potential trades with support and resistance. Look at the example below. This is the GBP/AUD pair, it is trending down on the W1 time frame. So you have located a pair that is trending down, now you would like to filter support levels to see how many pips you could possibly make by selling this pair.

In the example below the GBP/AUD is trending down on the W1 time frame, which is a large time frame. This pair could trend much lower and the next support level is hundreds of pips away, this is a great trend trading opportunity. You could set a price alert at around 1.7700 (see top yellow line), it has 800 pips of potential below there, which is fantastic. Trading forex trends on the large time frames can provide superb pip potential compared to any scalping methods.

If a pair is in an uptrend on one of the larger time frame you could do the same thing by filtering resistance levels, since you are trading in the opposite direction.

Locate The Trade Entry Point

At this point the trader knows the direction of the trend, the time frame, and the pip potential. Now the trader needs a verified entry point to sell this pair. The final filter is the entry point into the trend. When you have a break of support or resistance on any currency pair it is easy to be notified with an audible price alert, which can easily be set on most trading platforms. These audible price alerts can also be sent to your email or phone.

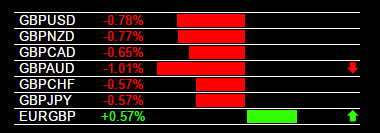

When you get the price alert, yo know that the support has been breached. At that point you need to verify the sell entry into the trend. In the example above the GBP/AUD is trending down on the W1 time frame. If you were to get a price alert that support was broken on the GBP/AUD at the first support level, denoted in yellow, you would then check the entry signal to make sure you have a valid entry point. Then you can enter the trend safely and start to ride the trend for several days or possibly longer. The signal system you see below is The Forex Heatmap®, in this case the GBP is weakening and it is likely safe to sell the GBP/AUD.

This image shows an example of GBP weakness on the heatmap, and this signal would validate the entry point into the larger downtrend on this pair. You would then execute a trade to sell the GBP/AUD, in the direction of the trend. Is might also be possible to sell the GBP/AUD if the AUD was consistently strong. The heatmap works the same way for 8 currencies and a total of 28 currency pairs.

Trading Forex Trends May Not Be Possible In Non Trending Markets

If you are interested in trading forex trends you have to realize that sometime the forex market is not trending. In this situation many pairs may be ranging or oscillating between support and resistance. In this case you can trade pairs that are ranging in wide ranges and on the shorter time frames. If you would like to trade ranging markets with the same set of moving averages and tools, check this great article about trading ranging forex pairs. In this case your risk to reward ratio is lower on each trade. Tools like The Forex Heatmap® become more valuable, along with money management skills.

Conclusions about trading forex trends with moving averages: Moving forward from scalping the forex market to trading with the trend on the higher time frames is certainly possible with the tools and indicators shown in this article. We believe trading with the trend or ranging markets can be successfully traded and pip totals can be increased for almost all traders.