In this article we will examine the various US Dollar USD news drivers, and how these economic news announcements impact currency traders on a day to day basis. We will also discuss several techniques for profitably trading these US Dollar news drivers.

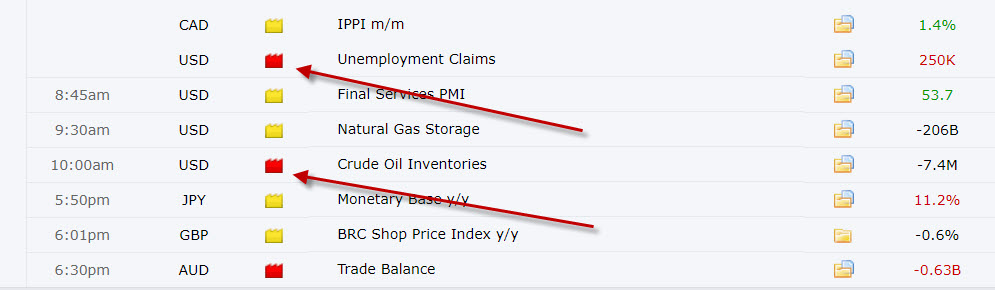

There are various economic news events that drive movement on the US Dollar against other currencies. Currency traders watch these news drivers, looking for opportunities to buy or sell the major currency pairs for short term profits, swing trades, or longer term trend trading. See the example below of the world economic news calendar showing some scheduled US Dollar news releases. Some examples of the US Dollar news drivers include Purchasing Managers Index, Unemployment Claims, Crude Oil Supplies, Non Farm Payrolls, and many others.

Volatility and price movement in the forex market can be expected after most of the scheduled US Dollar news announcements. Some US Dollar news announcements like the Federal Funds Rate, Non Farm payrolls or the FOMC Statement can provide substantial volatility and price movement. Volatile US Dollar news announcements occur between 25 and 30 times per month, not to mention all of the volatile news announcements from the other seven currencies we trade. There are plenty of times throughout the month when traders should be watching the market around these US Dollar news announcements. The top 7 major currency pairs that can be traded that are influenced by US Dollar news include the USD/JPY, AUD/USD, NZD/USD, USD/CAD, EUR/USD, USD/CHF, and GBP/USD.

Example US Dollar News Announcement:

On Friday March 6, 2015, the non farm payrolls US Dollar news was announced, like it always is on the first Friday of every month. Non farm payrolls is a monthly statistic researched, recorded and reported by the U.S. Bureau of Labor Statistics. Total non farm payrolls rose by 295,000 jobs for the prior month in February, shattering expectations for 235,000, resulting in the US Dollar strengthening. The employment situation report indicated that the February unemployment rate had fallen to 5.5%, down from January’s 5.7%.

How The US Dollar News Impacted Traders

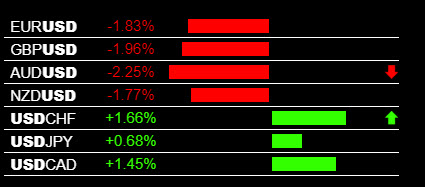

After the non farm payrolls news driver the US Dollar (USD) strengthened on all pairs. Traders could have profited from the price movements that happened after the non farm payrolls news drivers, if they have access to real time professional tools. Check out the live indicator below, this is called The Forex Heatmap® forex heatmap. The heatmap can tell you in real time what pair to trade, and in which direction. It works for 28 pairs, including all 7 of the US Dollar pairs. After the NFP news the heatmap indicated USD strength in real time. The arrow system pointed traders to the USD/CHF for a buy and the NZD/USD for a sell.

The readings on the heatmap tell you how far these pairs moved. A 1.6% movement on the NZD/USD is about 115 pips of movement, and a 1.12% movement on the USD/CHF is about 110 pips. The entire group of USD pairs moved hundreds of pips total.

From the standpoint of the trends of the market, the NZD/USD drop was in the direction of the long term downtrend on this pair. This pair should continue down to the 0.7225 support level and likely continue lower. So any sell trade on this pair would have resulted in an intraday profit, but also ongoing pip potential in the direction of the trend. Traders can use the heatmap to make informed buy or sell decisions on a day to day basis for trades in the direction of the trend, or possibly short term trades (day trades) against the trend. We have a great article that discusses trading non farm payroll NFP in more detail for further reading on this subject.

All US Dollar news events on the world economic news calendar are of great importance to traders. The same thing goes for news events from all of the currencies we trade. Making pips is possible from any of these economic news announcements with our trading tools and live indicators. If the US Dollar has a series of economic news showing that the economy is strong in the USA, and inflation is heating up, the US Dollar could start to strengthen against other currencies as the Federal Reserve starts to raise interest rates. Then, long term trends could form on pairs like the USD/CHF and USD/JPY. As trend followers we find this information to be vital.

Unscheduled US Dollar News

The economic news calendar shown above will give traders access to scheduled US Dollar news drivers, along with news drivers from all 8 currencies that we trade. Sometimes world political events, natural disasters, government of central bank actions, etc., can cause strong movement in the currency markets. We recommend using audible forex price alerts to supplement the scheduled news drivers for better monitoring of the 28 pairs we follow. Finding strong movements and breakouts gets easier with multiple alert systems.

Conclusions – Currency traders like the US Dollar and the major pairs for trading, knowing how strong the dollar is in real time, is extremely valuable to them. Live indicators like the heatmap are strongly favored by traders for increasing trading accuracy on the US Dollar pairs. If traders would analyze all 7 major US Dollar pairs daily, they could easily determine if the US Dollar is strong or weak with simple trend indicators. This would lead traders to being able to perform a daily US Dollar forecast. We analyze the US Dollar daily at Forexearlywarning, along with 7 other currencies. We also prepare a forecast for the US Dollar every day.