This is a trend analysis of the GBP/CAD pair using the higher time frames and support and resistance breakout points. With the Forexearlywarning trading system we use multiple time frame analysis, with a focus on the higher time frames, as our market analysis method.

In the example below you can see the W1 time frame trend on the GBP/CAD. Currently this pair is in a nice uptrend with more upside potential to about the 1.7300 area which is about 500 pips above the current pricing. Most forex traders work with the smaller time frames but moving to the higher time frames on trending pairs will result in much more pip potential.

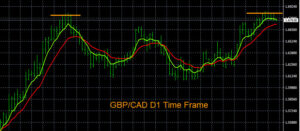

Now lets move to the D1 time frame trend and continue the analysis. The resistance level the GBP/CAD needs to break to continue in the W1 uptrend is around 1.6820, see the yellow line.

By checking all of the GBP pairs we can see that the GBP is starting to weaken slightly so the 1.6820 price resistance point might be a short term rejection point. A reversal back down or retracement may occur over the next couple of days. You can see the repetitive nature of the 1.6820 resistance level on the D1 time frame chart. Traders can watch our video on how to set audible price alerts for any currency pair to monitor any pair for a price breakout.

We would advise setting an audible price alert at about 1.6830 to monitor for a price breakout into the W1 uptrend. Then check the pair again tomorrow for a possible reversal back down using our trade entry management tool.,The Forex Heatmap®. The heatmap vill give you the short term direction and trade entry management guidance.

Using multiple time frame analysis and setting up the charts by individual currency will always reveal what is going on with any currency pair. You can use our heatmap tool plus the smaller time frames to enter any trade, but the higher time frames give you the overall perspective.