Forex candlestick charts are in wide use by forex traders, but how effective are they at helping traders to trade more profitably? The short answer is probalbly no. If used correctly we see a small amount of potential, but there are much more effective ways to analyze the forex market and set up your charts and indicators.

What Is A Forex Candlestick Chart

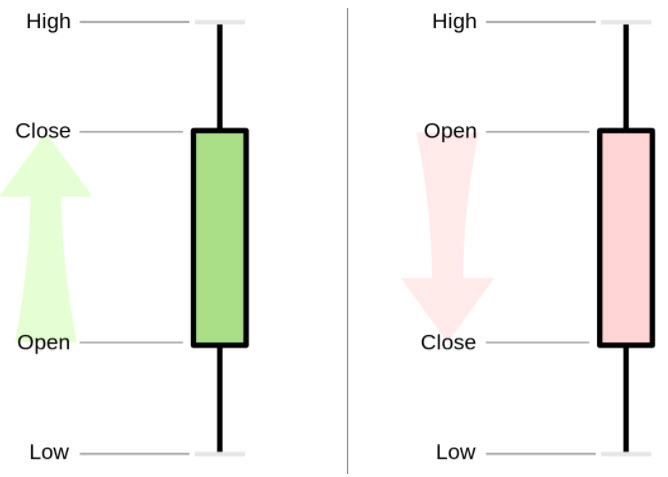

Forex candlestick chart patterns are a form of charting analysis used by forex traders to identify potential trading opportunities. Sometimes they are called forex candlestick charts or Japanese candlestick charts.

Most Commonly Used Forex Candlestick Patterns

Some of the most popular forex candlestick patterns include the doji family, tweezer tops / tweezer bottoms, the hammer family, three inside ups / three inside downs, evening star / morning star. In total there are around 50 recognized forex candlestick patterns. If you combine these 50 candlestick patterns with 9 time frames most traders use, you start to see potential problems developing for their use. For example, what is the best time frame to use candlesticks on?, and why. Some candlestick patterns are considered bullish or bearish, but this is only for a few pips on the smaller time frames, on one or two pairs, with high risk. Much better chart setups are available for traders without candlesticks to make strong profits with lots of confidence at the point of entry.

How Do Forex Traders Use Candlesticks

Typically, forex traders don’t have much of a strategy for using candlesticks. They simply do what is convenient, then suffer the consequences. They set up candlesticks on one currency pair, then use popular candlestick chart patterns for entering trades on one or maybe two pairs. Almost all forex traders who use candlesticks do this. Forex traders use candlesticks because they see other traders using them and they have not researched other options which are much better. Their approach to using candlesticks is random.

Randomness does not account for any momentum in the individual currencies in each pair and will never result in more than a few pips on any one trade entry. The risk of doing this is too high with almost no pips in return. The reward versus risk in unacceptable. Traders defaulting to scalping the smaller time frames will be the result. Any positive pips on any trade will be random results, considering that there are over 50 candlestick patterns and 9 time frames or more. There is no upside or advantage of using candlesticks in this manner.

Do Forex Traders Need To Use Candlesticks

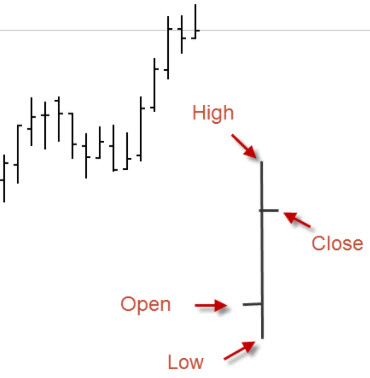

Forex traders do not need to use candlesticks, if forex traders used barcharts (open, high, low charts) without the candles, then set the barcharts up the way we show you to below, candlesticks would not be necessary at all. Candlesticks offer no advantage to forex traders, not even a few pips of profit advantage.

Barcharts give you the same information as candlesticks, so in this regard candlesticks have no advantage at all. They provide a different visual look, but if you attach barcharts or candlesticks to individual pairs you will still fail as a forex trader because you have no confirmation of the trade entry.

Are There Better Alternatives To Candlesticks

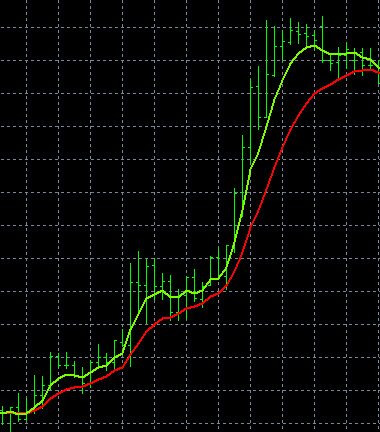

Yes most definitely so. We suggest setting up barcharts instead of candlesticks. Next step would be to install some exponential moving average trend indicators with the barcharts across 28 different pairs. After that rearrange the charts by individual currency. Using this plan for chart setup you would group all of the USD pairs together, then all of the CAD pairs together, etc. and repeat the process for the top 8 most liquid currencies.

Why would you group the pairs together with one common currency? Because, for example if all of the EUR pairs are trending up on the D1 time frame, you know that the EUR is strong and you can buy one of the EUR pairs. In some cases, you can trade all of them based on EUR strength. If you do this across 8 currencies you are starting to build a powerful trading system for currencies across 28 pairs, without any candlestick charts.

Example Trade Without Candlesticks

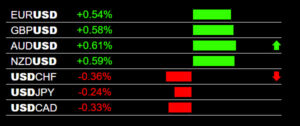

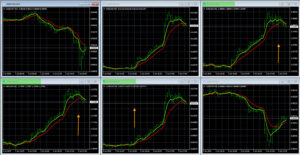

Look at the example USD pairs trades below with logical chart setup. On this trading day in the main forex trading session, the USD was weak on all pairs, causing considerable price movement. With the live heatmap indicator and consistent chart setuo with barcharts, you have eliminated the need for candlestick charts and at the same time created a much better trading system. Traders can set up their charts this way with proper correlated pairs for 28 forex pairs plus gold pairs.

Without the use of any forex candlesticks, you could have captured a great movements on the USD pairs in one trading session while trading with much higher confidence. The overall movement in all of the USD pairs was hundreds of pips. The live indicator you see for trade entries and momentum is The Forex Heatmap® forex heatmap , a live visual map of the forex market. This same trading system works for 8 currencies and 28 pairs. Compare this simple trading system with a stand-alone chart with a candlestick chart formation attached to one pair. In this regard forex candlesticks have no value to traders.

Conclusions about forex candlesticks: Forex candlesticks are in wide use by forex traders. But their effectiveness at making more than a few pips here and there is questionable by attaching them to one pair. In this article we give forex traders a clear simple, easy to set up alternative to candlesticks that will get the momentum of the market on their side across 8 currencies and 28 pairs, while bringing in many more pips into their forex trading. Forex candlestick charts are popular with traders but we have no idea why. Using candlestick charts because they are popular is the wrong reason.