- Categories

-

Recent Posts

- High Confidence Gold Trading System

- Fine Tuning Your Forex Trade Entries

- GBP/CHF, EUR/GBP Example Trade Entry

- Live Trading Capital: Funded Forex Account, Forex Funding

- Forex Mobile App On Telegram

- Forex Scanner, Real Time Screening Signals For 8 Currencies

- Forex Audio Book, MP3 Library

- Forex Trading Seminar — Can I Become A Forex Trader?

- GBP/JPY Trend Reversal

- Forexearlywarning, Introduction To Our Complete Trading System

Author Archives:

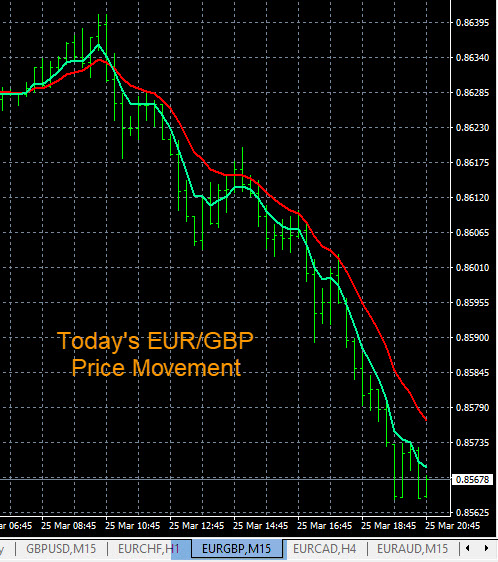

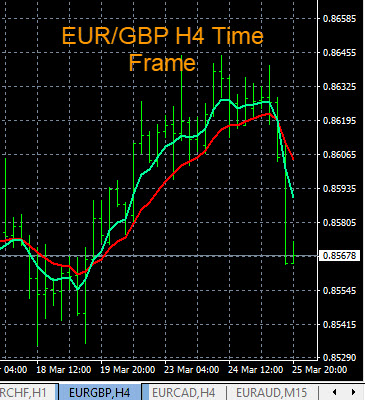

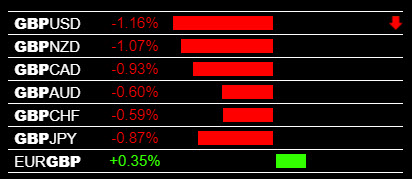

Forex Trend Charts EUR/GBP

Here are some forex trend charts for the EUR/GBP on various time frames. We will use them to prepare a forecast forecast for the EUR/GBP currency pair movements over the next few days. The EUR/GBP dropped in todays trading. The drop was due to the GBP strength you see on our live indicator. The Forex Heatmap forex heatmap. The EUR/GBP dropped today and is headed for a bigger support level on the H4 time frame. at 0.8550. Our forecast is that the EUR/GBP will drop to this support level, then traders should exit any sell positions. In 1 to 2 days this pair will reverse back up into its normal range seen on the H4 time frame chart below.

The red and green lines you see on the charts you see are some easy to set up forex trend indicators Traders can set the trend indicators up by individual currency. In this case you can set up all of the GBP pairs together, so you can see how the EUR/GBP is moving for your trade entries. Traders can perform their overall market analysis using multiple time frames across each individual currency for enhanced accuracy.

Use these handy links to learn how to analyze support and resistance levels on the smaller and larger time frames, and for more options for setting up your trending indicators metatrader setup options for market analysis. If you have the right analysis tools set up by individual currency you can successfully trade the EUR/GBP, other GBP pairs, or make forecasts.

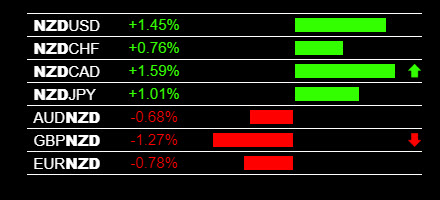

Forex Alerts NZD Strength, Trade The New Zealand Dollar

If you are a forex trader looking for a set of NZD New Zealand Dollar alerts, trading signals and trading indicators, these will improve your trade entries tremendously. These same indicators and trading signals work for 8 currencies and a total of 28 pairs, not just the NZD pairs.

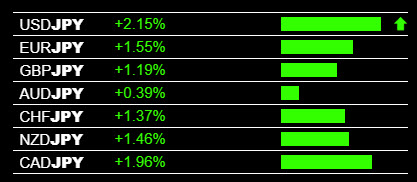

The first indicator we want to show you for trading the New Zealand Dollar pairs is The Forex Heatmap®, which gives live NZD buy and sell signals for all 7 NZD pairs. Here is an example trading signal:

The live trading signals on the heatmap for the NZD indicate NZD strength during this trading session. The NZD strength is across the board against all major currencies. Due to some slight CAD weakness, the NZD/CAD made a strong movement of about 125 pips, which is a strong move for this low volatility pair. The trend indicators on the bottom image can be set up with all of the NZD pairs grouped together like the heatmap for reading the NZD or any other currency much more accurately.

For more exact times to be notified as to when the NZD New Zealand Dollar is consistently strong or weak we have some professional forex alert systems like audible price alerts and push alerts to your cellphone to tell you when the market is moving. Now you have access to great live indicators, a trend and charting system and alert systems. As a forex trader you are now on the way to building a profitable forex trading system for the NZD pairs and 7 other currencies.

EUR/NZD Chart, Trend Analysis

Here is an analysis of the EUR/NZD chart using some simple trend indicators on the higer time frames. This is the W1 time frame chart. Visual analysis shows that the EUR/NZD is in a longer term downtrend that might last many more weeks. Current pricing is about 1.6110. Traders can set an audible price alert below this price. When the alert hits check The Forex Heatmap® forex heatmap for a sell signal.

We see considerable pip potential below the alert price, down to as low as the 1.4300 area, which is 1800 pips of potential. This means that the risk to reward ratio would be 60 to 1 with an initial stop of 30 pips. This is a phenomenal risk to reward ratio for any forex trader to use. Most forex websites emphasize scalping with 1.5 to 1 or 2 to 1 money management ratio. This trend analysis was accomplished with multiple time frame analysis by individual currency, using using some simple forex trend indicators. The trend indicators you see are some 5/12 exponential moving averages. These moving averages are simple, but powerful when applied across individual currency groups.

GBP/AUD Sell Signal

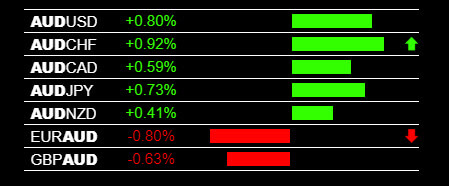

This is an example of a strong sell signal on the GBP/AUD pair today. The indicators you see below is The Forex Heatmap® forex heatmap, which provides live trading signals for 8 currencies and 28 pairs total. As you can see from the signals, the British Pound (GBP) was consistently weak and the Australian Dollar (AUD) was also consistently strong.

This is the strongest possible trading signal using this indicator. We refer to this as a “slingshot”. The best indicator you can use to trade the forex market with is the market itself. These strong signals pushed the GBP/AUD down 175 pips in one trading session. The AUD strength pushed the AUD/NZD up around 100 pips, so multiple trades were possible due to the market volatility.

This GBP/AUD is now in a strong down trend and should continue much lower on the W1 time frame trend, we see no nearby support levels below the current pricing. We will continue to prepare more trading plans for additional sell entries moving forward, in the direction of the ongoing downtrend.

Forex Signals AUD Strength, 7 Pairs

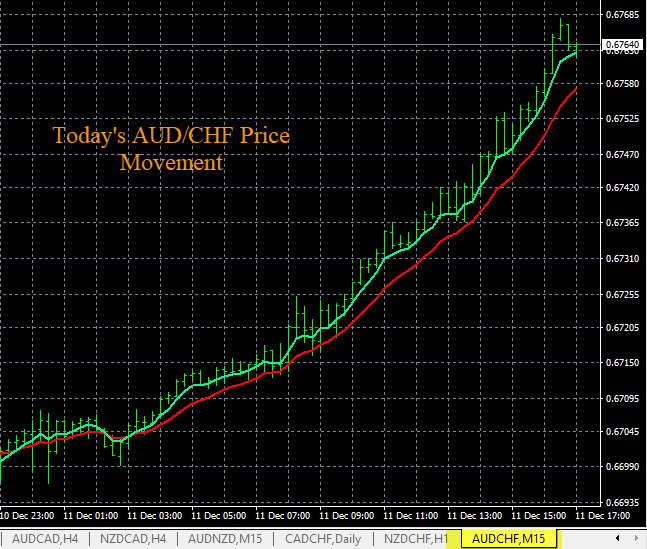

If you are a forex trader and you would like to trade the AUD pairs like the AUD/USD and the EUR/AUD, we have a great signaling system and chart setup for you. Forex traders need better trading signals that are easy to read. See the AUD strength live trading signals shown below. Trading the AUD (Australian Dollar) pairs gets much easier with real time signals like this. In the example below the AUD pairs signaled AUD strength across the board.

This created strong movements and several trading opportunities on trending pairs. The AUD/CHF moved higher in it’s current uptrend and this pair should continue higher on the D1 time frame trend. The EUR was mostly weak so the EUR/AUD sold off and should continue down to at least the 1.4650 support level, as this pair is in a strong downtrend. Combined movement for all 7 AUD pairs was in the hundreds of pips.

The AUD strength signals you see below are from The Forex Heatmap®, which provides much more reliable signals than any forex trading signals we have seen that are available to traders. These signals work for all 7 of the AUD pairs and a total of 8 currencies, 28 pairs total. We send push alerts to your cell phone when the market is moving consistently across any currency, 24 hours per day. We also have a chart setup where you can view all 7 pairs at a time to match the heatmap.

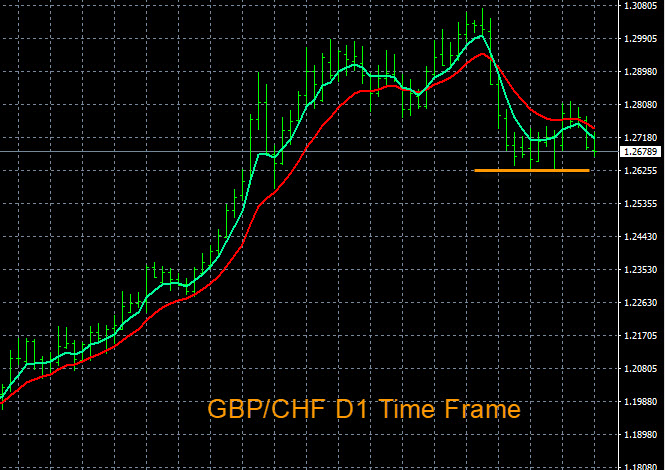

GBP/CHF Trading Plan

Todays GBP/CHF trading plan is presented here. This pair is close to breaking support on the D1 time frame and possibly forming a W1 time frame downtrend also. Traders should set an audible price alert at 1.2630, noted by the yellow line, to notify them of the breakout. When the alert hits check the The Forex Heatmap® forex heatmap to verify any sell entries. We would expect the GBP to weaken below the alert price.

This pair has substantial potential below the alert price with no nearby support levels. This trading plan for the GBP/CHF was prepared using multiple time frame analysis by individual currency. This is the analytical technique we use every day at Forexearlywarning. Traders can check our website for more information on how to prepare a forex trading plan.

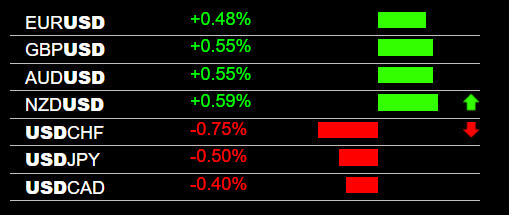

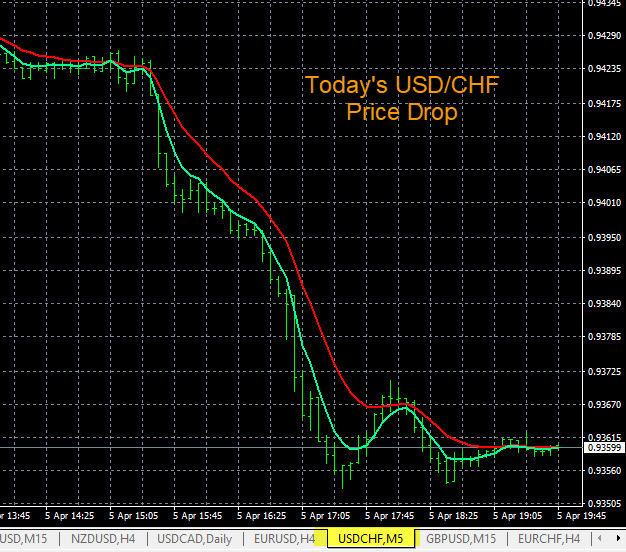

Currency Trading Signals USD/CHF

Today in currency trading the USD/CHF moved much lower after the USD economic news announcements. The live trading signals for the USD/CHF are below. After the news drivers in the main trading session the USD (US Dollar) weakened and the CHF (Swiss Franc) was slightly strong, pushing the USD/CHF much lower. Core Retail Sales and Producer price index were the USD news drivers at 830 EST today.

The USD/CHF has hit intra-day lows of 0.9355. The USD/CHF is trending lower on the major time frames and has considerable additional potential to drop further. The intraday drop was bout 80 pips. Forex traders can profit from this type of live signaling system every day, and many times after forex news drivers.

The live currency trading signals you see below are from The Forex Heatmap® forex heatmap, which is a visual map of the forex market, it provides live trading signals for 28 pairs, including all of the major pairs shown below plus 21 exotic currency pairs. We send push alerts to your cell phone when the market is moving.

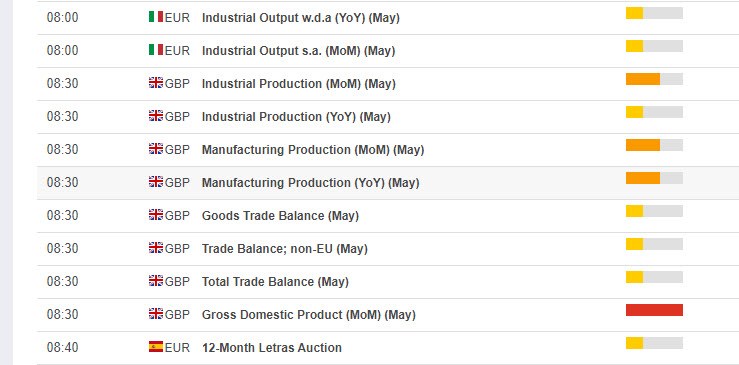

Forex News Calendar, Selecting One For Your Trading

In this article we will review and compare forex news calendars, and features that are available to traders. We will review what features and functionalities are best to have when selecting the best news calendar to meet traders needs.

A forex news calendar is an important tool for forex traders. If you combine a good quality news calendar with other tools listed below, a trader can be on the road to successfully trading forex news drivers. Traders will always be in front of the computer when news is potentially creating volatility and price movement.

Features to Look for In A Forex News Calendar

Some features in a forex news calendar are important to have, others we do not believe are needed. Probably the most important news calendar feature is the interface. If an news calendar is easy to read, with well spaced text, and easy to read controls, The end user experience will be positive. News events should have color coding for better visibility.

Most forex news calendars have a set of controls for customizing the news calendar features. With most calendars, traders can add or remove currencies that they want to see scheduled news drivers for. We suggest setting up the news calendar for reporting scheduled news drivers for the 8 major, most liquid currencies: US Dollar, Canadian Dollar, Euro, Swiss Franc, British Pound, Japanese Yen, Australian Dollar, New Zealand Dollar. These 8 currencies combine into 28 different pairs, and these are the pairs we track with the Forexearlywarning trading system.

Another calendar control or filter would be to set up the news calendar for the most volatile news drivers only. Look at the above news calendar. It has one volatile news driver on the schedule from the GBP that is upcoming. You can set up and customize the calendar to show only high impact news drivers, color coded in red. High impact news crivers can drive substantial price movement. You can also customize for red and orange color coded news drivers only. Orange news drivers are medium impact news drivers.

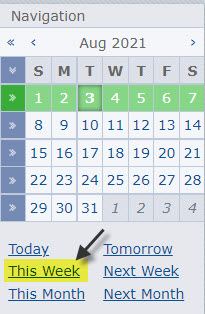

This way the calendar is more compact. Most forex news calendars also come with adjustable clocks. Users can set the calendar clocks to local time or the GMT time clock, whatever the end user prefers.

Make sure the news calendar you choose has a look ahead calendar for planning your trading week. Click on the “this week” to see the entire week of important news drivers on one screen. This helps with planning your trading schedule if you are on a tight schedule. You can also use the look ahead schedule to see when major bank holidays are. USA bank holidays are good days to take a day off from trading or take a long weekend. Every trader needs an occasional mental break.

Make sure the forex news calendar you are using is on a website that is fast and the pages load quickly on your laptop or any mobile device like Android or Ios device. Many news calendars have a lot of popup advertisements that make the pages load very slowly. Choose a calendar with little or no advertisements on the page to improve page loading speed on mobile devices.

Some news calendars have alert systems news alerts, alarms, and or apps. These features are fine but not necessary because you will always know when the important news drivers are in advance. Traders can also use other professional forex alert systems with the news calendar to know when the market is moving on any pair.

How To Use A Forex News Calendar For Trading

A forex news calendar will pinpoint exact times to be in front of the computer in local time or GMT time clock. With this knowledge a trader can be in frot of the computer at the proper time for a potential trade and market volatility.

To complete your tool set for trading, you would need a forex trading demo account, an entry management confirmation system like The Forex Heatmap®, and a set of simple and easy to set up trend indicators. You can find all of these trading tools on the Forexearlywarning website and a demo trading account is available from any forex broker.

With this tool set you are ready to start demo trading, almost immediately. After any scheduled news driver on the 8 currencies we follow, you can check for consistent strength or weakness in one currency, then if the movement is in the direction of the major trends on the higher time frames, you can enter a demo trade.

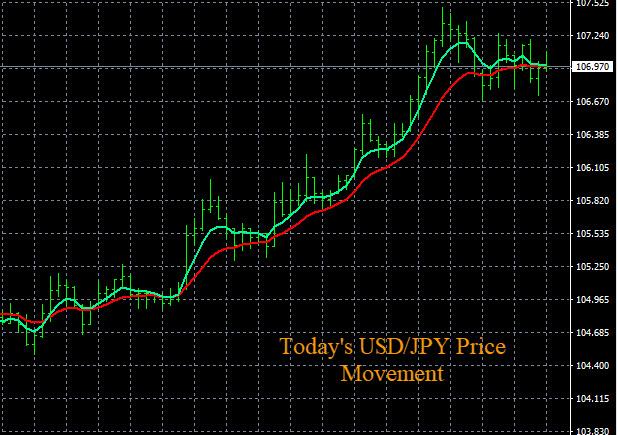

If there is a JPY news driver on the news calendar, wait until the news is announced, then start monitoring the JPY for consistent strength or weakness using The Forex Heatmap forex heatmap, our real time trade entry indicator. If the signals are consistent JPY weakness then you can buy the USD/JPY or on of the other JPY pairs. Use the same strategy to buy or sell 28 different pairs. Ifthe USD/JPY is in an uptrend on the higher time frames, more pips are possible going forward.

Forex News Calendar Selection

The news calendar selection process is simple. Just do a google search for “forex news calendars”. Some popular calendars will appear on the first two pages of search results. Dailyfx Babypips, Forexlive, etc. all have news calendars to review. Forexearlywarning also has a great world economic calendar on our website, along with the other tools like trend indicators, price breakout alerts, and The Forex Heatmap®, for trade entry management. The documentation how to use these tools is also on our website. After reviewing some calendar options pick one you like that has the features you need.

Conclusions about forex news calendar selection: After you select the best news calendar for your needs, set up the features you like and you will have an important piece of your forex trading system. Then continue building your trading system and test the system with some demo trading. Then the final step is trading profitably with real money, micro lots and mini lots.

Bank Of England Base Rate, Monetary Policy

Today in forex news the Bank of England base rate remained unchanged. The Monetary Policy Committee voted 8-1 to keep interest rates unchanged. The announcement came today at 1200 GMT. The Monetary Policy Committee (MPC) also signaled that interest rates would remain low and steady. The central bank also lowered its economic growth forecasts.

The Bank Of England Base Rate news today caused the British Pound (GBP) to sell off, and this news impacted forex traders. The GBP/NZD sold off, due to some NZD (New Zealand Dollar) strength in the market. The GBP/NZD is hitting session lows at 2.2950, the overall sell off was nearly 400 pips, which is a very strong intraday selloff. The GBP also dropped against the USD, and this pair is down to session lows of 1.5120. You can see the strong selloff on the GBP/USD on the chart below.

Traders could have profited nicely after today’s news. Both sell trades on these two pairs look like short term/intraday sells, we expect the GBP/NZD to reverse back up based on the larger trends in the market. This pairs sold off but it is not trending down on the larger time frames. The GBP/USD also sold off, but this pair is still ranging up and down, so we would scale out lots or exit completely on any short term/intraday trades. The trading system you see above is The Forex Heatmap®, which provides live buy and sell signals for the GBP pairs and 7 other currencies, and 28 pairs total. The Bank of England Base Rate news, or interest rate news on any currency is one of the criteria used for forex fundamental analysis for any currency. Interest rates drive currency price movement and trends. Monitoring forex news is part of any great trading system.

Forex Trading Plan GBP/NZD

This is our current trend analysis and trading plan for the GBP/NZD. The D1 trend is pointing up and the trend cycle is new and just starting. Forex traders should set an audible price alert at the 2.3380 level, shown on the charts. When the alert hits check The Forex Heatmap® for a buy signal. You should look for consistent GBP strength or NZD weakness, or both, on entry using the heatmap signals. We use the smaller time frames plus the heatmap to enter trades into the existing trends on the higher time frames. There are several GBP news drivers upcoming in the main trading session, so strong movement is possible.

Past the price alert point there is plenty of upside potential, possibly to the 2.4400 area, which is approximately 1000 pips. We prepare written forex trading plans daily for 28 currency pairs and 8 currencies using multiple time frame analysis. Combine a trading plan with a great signaling system and you can have powerful results trading the spot forex market.