Using Currency Correlations To Improve Your Trading

Currency correlations can help traders to understand how a particular currency moves in relation to another market, another currency or a specific commodity. This article will explore these currency correlations to enlighten currency traders about how currencies move in relation to other world financial markets.

General Information About Market Correlations

A market correlation is a mathematical equation that describes how individual trading instruments, markets or domestic or international markets move in comparison to each other. It is a statistical measure of how two securities move in relation to each other. An individual currency or currency pair also has correlations to other currencies or pairs.

Correlations are always in the range of -1.00 to +1.00, which is the correlation coefficient. A negative reading suggests that one instrument consistently moves up while the other moves down. A reading of -1.00 means perfect negative correlation, two securities which move in opposite directions. Conversely a positive reading suggests there is a tendency for the instruments move together in the same direction or move in tandem. A correlation coefficient very close to 0.00 means there is no correlation. There are long term correlations and short term correlations. Correlations are dynamic, they change over time. Correlations may vary considerably over different time periods. The 1 day correlation could be negative and the 6 month correlation could be positive between two markets or instruments.

There are many types of financial correlations. There are correlations between groups of securities inside one country or region, and correlations between asset classes in different countries or regions. For example there is a correlation between individual US stocks and the US stock market index, like the S and P 500. There is also a correlation between US stock market index versus US Bond Index. There are correlations between the US Dollar and gold or the US Dollar and oil.

Correlations between geographic regions also exist. There are correlations between the US stock market index versus international stock index, and correlations between the US stock market index and the Canadian stock market index.

Currency Correlations

Some example currency correlations are discussed here. If the inflation rate was to start going up, the price of gold should be rising because these two instruments track each other and are correlated. If the Canadian Dollar (CAD) is rising, the price of oil is almost always rising. If the Euro is rising and the British Pound is falling, this dynamic causes the EUR/GBP pair to rise rapidly, creating an opportunity for all currency traders. This is true for any combination of two single currencies, so many opportunities for currency traders are possible with these correlations and dynamics.

.jpg)

In an orderly market these correlations generally hold on a day to day basis. In a choppy market the correlations could be reversed on a day to day basis. This knowledge would be helpful to any trader who has mutual funds, commodity mutual funds, commodity traders, stock traders, and to some extent forex traders. If various markets are in sync the markets are generally trending, with clear and strong daily movements. If the markets are out of sync where the short term correlations are the opposite of the long term correlations, you can have a non trending or choppy market.

Correlations Between Currency Pairs

Basic strength/weakness correlations: Correlations between pairs with one common currency are easy to identify and understand.

Example #1: The correlation between the NZD/USD and AUD/USD can be measured using the AUD/NZD. If the NZD/USD and AUD/USD are both rising, the US Dollar is weak against the Australian Dollar and New Zealand Dollar. In this case the AUD/NZD should be going sideways.

Example #2: If the AUD/USD is rising and the NZD/USD is falling, the correlation between these pairs can be measured by the movement on the AUD/NZD. It will be moving up rapidly in this situation. This correlation can be of very high value to forex traders for profitable trading.

Example #3: Basic strength/weakness correlation: If the EUR/USD is trending up and the USD/CAD and USD/CHF is trending down down etc, almost without looking you would expect the USD/JPY to also be trending down because you know the USD weakness could be dominant.

These simple correlations make the forex market somewhat more predictable beyond what most forex traders believe.

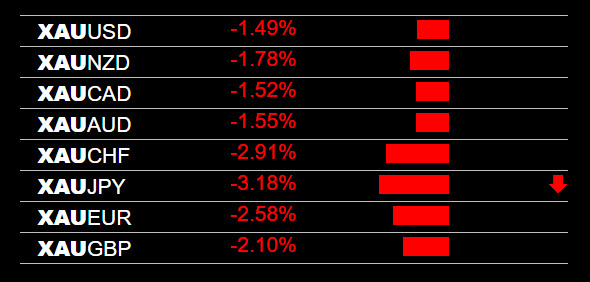

Real time currency correlations can be visualized and are extremely valuable to forex traders. In the above image the real time correlation between the British Pound (GBP) and Japanese Yen (JPY) can be clearly visualized with the real time tool called The Forex Heatmap®. The GBP/JPY correlation is clear, as well as the GBP/USD correlation. Using this real time correlation heatmap, selling the GBP/JPY or the GBP/NZD is indicated and the signals are clear. Signals like this can be referred to as real time currency correlations, currency strength, or parallel and inverse analysis of pairs, in real time for traders to utilize.

If you are a forex trader and you are looking for a real time currency correlation strategy, you can use the heatmap and parallel and inverse pairs to tell which currency pairs, or groups of pairs, are moving in the same direction. A real time currency correlation indicator, or currency pair correlation indicator is a valuable part of all trade entries, for short term day trading, or for trade entries into the larger trends and time frames

Gold Traders

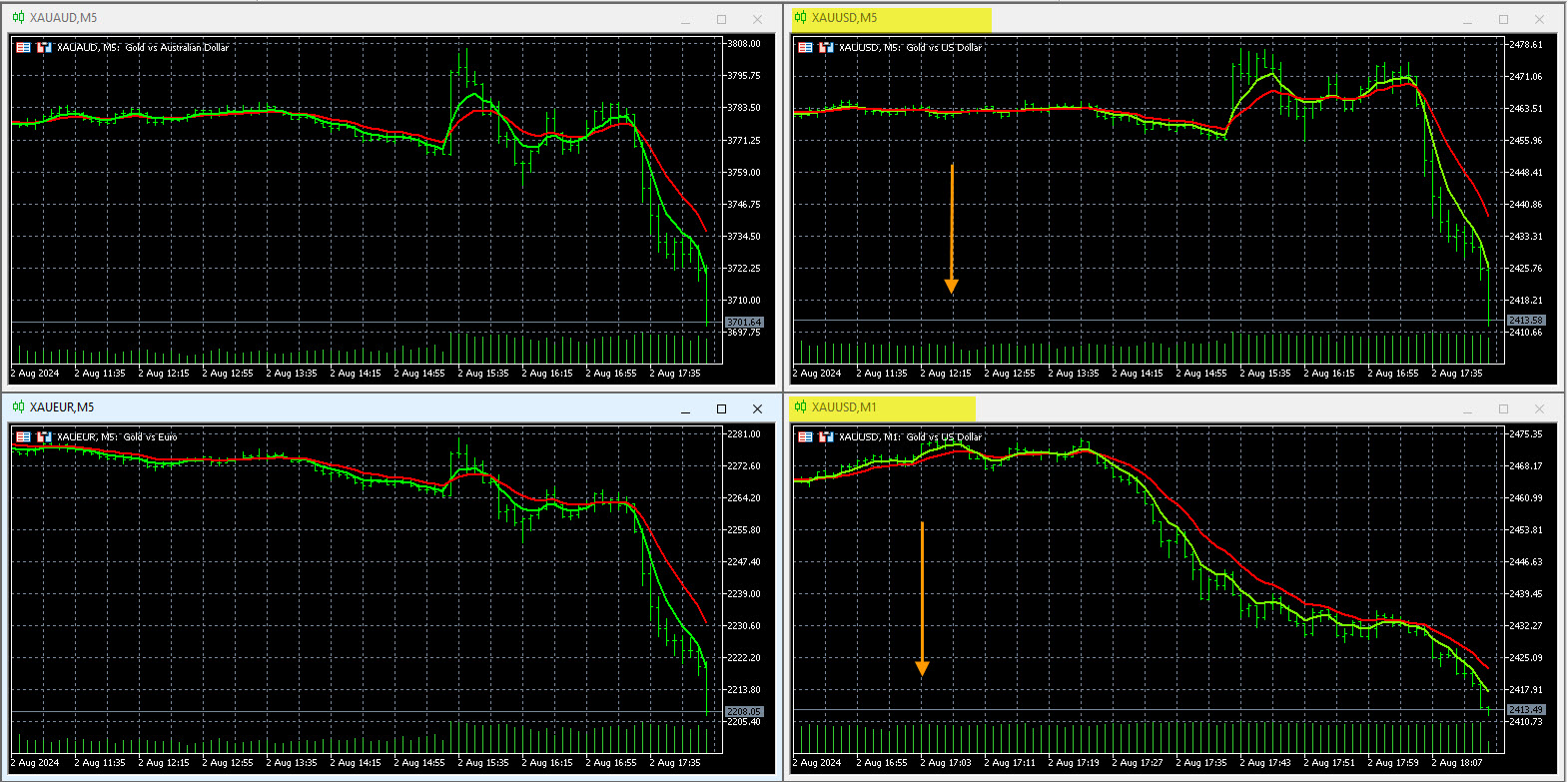

If you follow the forex news calendar look for the news that is related to inflation. If inflation begins rising in the USD or worldwide, the price of gold will rise and this asset can be traded with our gold tading system. Our gold trading system uses the sam principles of our forex trading system and is quite popular with our clients with the correlated pairs chart setup.

Are Currency Correlations Important To Traders

In some cases currency correlations are important to currency traders, and in some cases they are not. From the standpoint of a trader, it is not very important to know if the price of oil or gold is moving up or down, because you are trading currency pairs and knowing these facts will not help for a trader to profit.

If a trader knows that the price of oil is dropping this will show up in the trends and/or live signal systems as Canadian Dollar weakness. If the trader can determine if the Canadian Dollar currency is weak or strong using some simple trend indicators, or the live signal system shown above, then this should lead to some profits selling the CAD currency. The trend analysis and trading signals is what leads to the profit, not knowing the price of a commodity. The currency market is massive compared to the commodity markets.

So if you have little or no knowledge of any of currency correlations you can still trade the forex using a trading plan, knowledge of the primary trend and The Forex Heatmap®, following no outside financial markets. Just analyze the currency market and pairs daily using multiple time frame analysis and use the heatmap on your entries for short term trades or entering long term trends and you will be just fine.

This material was presented to acknowledge the currency correlations between the forex market and other markets. Traders can go deeper into this subject and do a little research and some web searches and start overlaying charts of various markets. This will help with your knowledge of how financial markets are correlated but it will not assist with making more pips. The forex is the largest and most efficient market and trading this market does not require this outside knowledge. It is just extra financial knowledge for those of you who want to go deeper into the subject. Daily trend analysis and an accurate forex signal system should be enough to get currency traders to profitability.