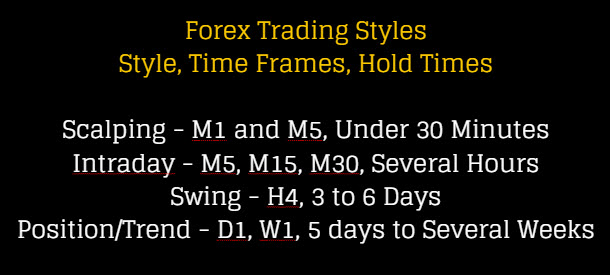

Forex Trading Styles: Scalping, Intraday, Swing, Position

There are four forex trading styles that traders can use: scalping, intraday trading or day trading, swing trading, and longer term position trading or trend trading. In this article we will review all four forex trading styles and point out the benefits of one style versus another for comparison.

Forex Trading Styles, Scalping

The definition of scalping is generally entering a spot forex trade for less than 15 minutes, looking for 10 or 20 pips of profit, sometimes even less. When a forex trader is scalping they are generally trading on time frames like the 1 minute or 5 minute time frame, so the upside is highly limited since the larger time frames contain all of the pips.

Should forex traders scalp? Since we have an effective trading system at Forexearlywarning, we believe the answers is definitely no. Scalping is a defense mechanism for a lack of knowledge, lack of a trade plan, lack of an entry management system, lack of an effective or profitable trading system, or compensating for ineffective technical indicators. Traders without written plans and proven entry management systems scalp and the poor results are widely known. Even traders who scalp the forex market readily admit that they do not like to scalp and they admit it has no future. Traders do not want to scalp, they want to make a lot of pips, but they scalp because “other traders are doing it so it must be okay”.

There are several reasons why scalping the forex market is not the long term answer to making a profit. When you scalp the market your forex money management ratio is negative on a trade by trade basis and eventually it will cause you to lose your funds. The money management ratio of any trade is the amount of pips you expect to make versus what you risk. The expected number of pips versus the initial stop is negative with forex scalping. For each pip at risk you are not trying to make more than one pip of profit. Any reasonable person knows that this level of profit is way too small for the risk of entry. With scalping if you are right 50% of the time you will lose your entire account.

Scalpers do not have an effective trading system, that is why they scalp, and some traders take on incredible financial risk with lot leveraging as part of their scalping strategy. Most traders would like to hold onto their trades much longer, and even scalpers know this, so we suggest traders closely investigate some of the other forex trading styles presented in this article. Almost all forex traders are scalpers, and the longer they trade the forex market, the less trade entries along with more pips per trade becomes their goal, and scalping becomes a poor alternative.

Forex Trading Styles, Intraday Trading

The next trading style we will examine is intraday trading, or day trading. The definition of a day trade is when a position is opened and closed on the same trading day. For the forex market we will assume the trading day is the main trading session where most of the market activity occurs. A forex intraday trade would likely be based on fresh movement cycles on the smaller time frames like the M5, M15 and M30 time frames, for a duration of approximately 1 to 6 hours. If a currency pair is consolidating a head of the main forex trading session it is a good candidate for intraday trading style.

Is intraday trading style a good trading style to use? The answer is in some cases, yes. If the market is not trending but is somewhat choppy, pairs tend to move in one direction for 1-2 days then reverse, but the daily movements might be strong. In this case you are using intraday trading to suit the market conditions. If traders analyze the market well every day using multiple time frame analysis, any choppy market conditions will be revealed.

When you enter an intraday forex trade, your pip potential is from about 20 pips to as high as 175 pips per entry, depending on the volatility of the pair traded plus the quality of the signals you see. Lets examine one example below.

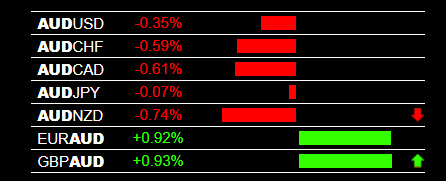

.jpg)

In this example of an intraday forex trade, the AUD is clearly weak on our live signal system, The Forex Heatmap®, and the pair has a strong intraday movement cycle of about 110 pips. If you use the intraday or day trading style, you would exit the trade completely at the end of the intraday up cycle, when the M15 cycle ends.

Forex Trading Styles, Swing Trading

The next forex trading style we will examine is swing trading. The definition of a swing trade is trading an individual cycle on the H4 time frame using the free trend indicators provided by Forexearlywarning.com. If you inspect the H4 time frames and cycles across the market you will see that swing trading cycles are approximately 3 to 6 days of holding time, and possibly longer. Each time the H4 red and green trend lines cross and change directions you can enter the trade using The Forex Heatmap® for entry verification. When the swing cycle is over and the H4 time frame red and green lines converge you would exit the trade. This works on trending or oscillating and ranging currency pairs, see the image below for an example of the forex trading style known as swing trading. Sometime the H1 time frame moves in tandem with the H4 time frame, but the best forex swing trading time frame is the H4.

We have presented two forex trading styles in this article: scalping and intraday trading, but your goal should be to swing trade or trade the higher time frames to fully conform to the Forexearlywarning trading plans. In order to have the proper money management ratio in any forex trade entry you must have a swing trading as a minimum objective or position trading objective as your trading style and hold on to each trade for days to weeks, if possible. But sometimes we understand that the market condition and trends will not support this style. Because our trading system has great tools and indicators, you can shorten the time frames and still likely make pips, but our philosophy is to trade the H4 and larger time frames whenever the market conditions allow.

Swing trading works in a trending or oscillating market. If a pair is trending up on the higher time frames like the W1 and MN, traders can enter trades on the embedded H4 swing cycles within a longer term trend. Or, if you see a ranging currency pair on the H4 time frame you could wait for one cycle to finish then when the pair reverses catch the new cycle, in the opposite direction.

Forex Swing Trading Example Number 1 – A currency pair is oscillating on the H4 time frame chart and is coming down, just let it finish the down cycle and stall at support, then set an audible price alert for a buy and ride the new H4 up cycle back up to previous resistance on the H4.

Forex Swing Trading Example Number 2 – In this example the currency pair you want to trade is in a long term strong uptrend on the W1 time frame. On a significant support or resistance break and fresh H4 time frame trend you enter the trade with confirmation from The Forex Heatmap®. You can then exit all or some of your lots at the next significant resistance or support and ride the H4 time frame trend higher.

Forex Swing Trading Example Number 3 – A currency pair can also move significantly against its primary trend, and when it reverses back into the direction of the primary trend on the larger time frames like the W1 or MN, you can re-enter the trade. This is called a swing trade setup. We have a complete lesson on swing trade setups that describes this trading style.

We believe that forex traders should use the swing trading style. It has the proper risk reward ratio, trade after trade and you pip totals can be quite high then trading swing cycles on the H4 time frame.

Forex Trading Styles, Position Trading

Position trading is when you enter a trade guided by the highest time frames. In this trading style you will be guided by the trends on the D1 or W1 time frames. Traders can use the same forex trend indicators shown in the image above. Trade entries into the larger time frame trends are also guided by The Forex Heatmap®, also shown above.

A position trading example is as follows: The D1 time frame has a fresh trend cross or developing fresh cross. If the D1 trend is oscillating ranging and you enter on a fresh cycle this also qualifies as a position trade. Obviously if the larger trends like the W1 time frame trends accompany the D1 fresh cross then the potential could be much higher on the W1 time frame. Sometimes a fresh W1 time frame trend can be found, when you see one once again all you have to do is verify the entry with The Forex Heatmap® and you could have a longer term trend trade or position trade.

Money Management Ratio And Trading Styles

The proper way to trade the spot forex is with a swing trading styles, or longer term position trading style, and the risk reward ratios clearly support this. With swing to position trades your money management ratio starts around +3 and goes as high as +50. For each pip you risk you expect to make between 3 to 50 pips. At Forexearlywarning we write trade plans with a basis of swing and position style plans and always trading in the direction of the major trends on the forex market. You can default to the intraday trading style if the market presents you with a shorter term opportunity, and you can trade these at your option.

Conclusions about Forex Trading Styles: The Forexearlywarning trading system is based on the higher time frames, H4 and larger. This means we are always looking for trends on the higher time frames swing trading style or position trading style. Swing and position trading styles have highly favorable money management ratios, which favor the traders. If the market conditions across 28 pairs do not have many trends, you can, at your option, default to intraday trading style, or possibly even day trading, until the market starts to trend again. At Forexearlywarning we write trading plans for swing trading and position trading styles, not scalping, however our strong real time tools like The Forex Heatmap® even make accurate intraday trading possible.