Forex Risk Management Strategies That Work

This article will present forex traders with 12 different ways to manage risk. Traders can implement the risk management strategies discussed below to maximize the number of pips into their trading account. If traders do not know what they are doing and they do it anyway, they are taking a risk. This statement is true for currency trading as well as anything else you do in life. One of the first things forex traders can do is acknowledge that there are risks associated with trading, then take action to manage or eliminate risk. There are several steps you can take to manage risk as a currency trader.

An Effective Trading System Is The Best Forex Risk Management

All forex traders need a trading system that produces pips. A system that consistently produces pips in your account is great forex risk management. If you start to demo trade your trading system of choice and the system does not work for you, it might be necessary to find a new trading system. Without a true trading system and some demonstrated proof that it will work for you, trading with live funds is not advisable. A complete forex trading system is elusive to most forex traders. Most forex traders think that if they have a couple of technical indicators on their charts, that their system is complete, which is far from the truth. At Forexearlywarning we offer a complete trading system and we ask all traders to evaluate our trading system versus any other system you find. It is a great, low risk trading system with high upside. All trading systems have risk, but compared to the alternatives available to forex traders, the Forexearlywarning trading system is the lowest risk/highest upside trading system available to forex traders. Look at the example trade below.

Accurate Trade Entries Is Excellent Forex Risk Management

Most forex traders are completely in the dark when they enter a trade. They have no idea if the trade will make positive pips. They are trading blind and taking big chances at the point of entry, for the most part because they are using technical indicators. If traders had an accurate trade decision tool, their success rate would skyrocket. When you enter a real money trade the only risk you take is the amount of your initial stop price: this is your transaction risk. If the trade proceeds in your favor and you move your stop to break even you now have a zero chance of loss. If traders can access a real time trade entry management tool that verifies the direction, risk of a loss would be greatly reduced or eliminated. At Forexearlywarning we tell traders to verify their trade entries in the main trading session with real time indicators like The Forex Heatmap®.

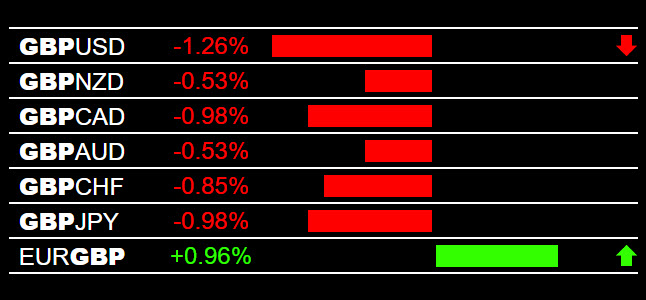

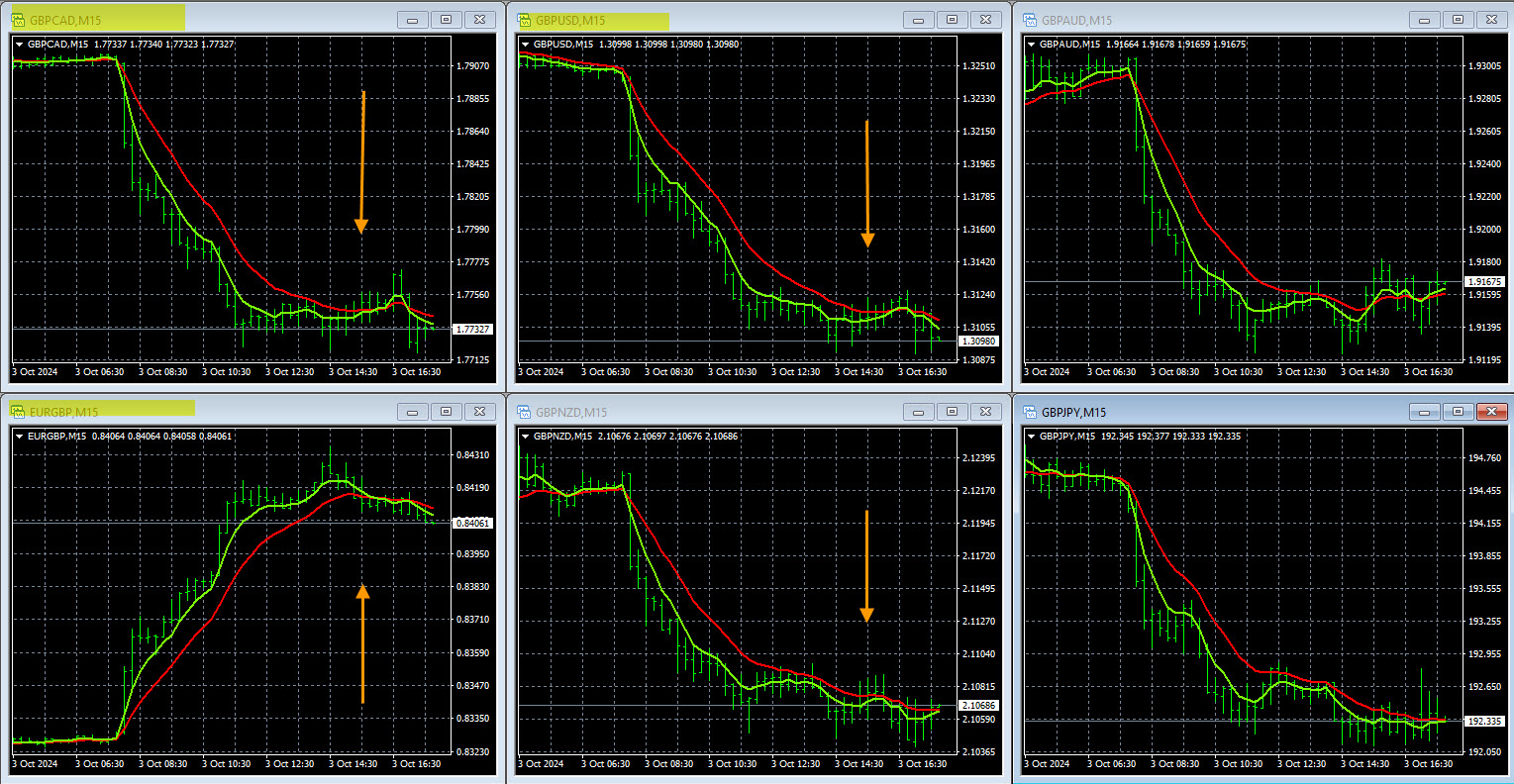

An example of the heatmap trade entry signal is above. If the GBP (British Pound) is weak and consistent, traders can sell the GBP/USD, or possibly a different GBP pair successfully. You can also buy the EUR/GBP. This live indicator works for 28 pairs and 8 currencies, plus gold. Now traders have a chance to go into positive pips on all trade entries. This will allow them to manage a profitable trade, which is a phenomenal forex risk management strategy that works, trade after trade. Along with verified trade entries, trading in the direction of the trends of the market reduces risk even further, and trading early in the trend cycles take your risk reward ratio strongly positive in your favor. Live trade risk can be dramatically reduced or eliminated with these tools and techniques. Using a trade entry management tool like The Forex Heatmap® is strong risk management or risk elimination.

Avoid Technical Indicators

Forex traders almost all use technical analysis indicators for market analysis, pair analysis and trade entries. This is ths single biggest reason most forex traders fail. One of the best ways to reduce risk is to completely avoid the use of technical indicators as part of your forex trading system.

Instead of technical indicators, Forexearlywarning can give you instructions for an excellent chart setup that will allow you to much more easily see how the market pairs and currencies pairs move. This great chart setup will dramatically improve your trading and pip totals.

Demo Trading Will Reduce Risk

A forex demo account will greatly assist with forex risk management. Traders can practice executing orders, setting and moving stops, and also test their trading system of choice. If you are using a trading system that does not work, you will figure this out before starting with real money trading, as to avoid losses. So demo accounts are indispensable forex risk management tools in this regard.

Once demo trades become profitable and traders learn now to manage the profits, traders can then move to live trading with micro lot trading with stops. After trading with micro lots, then they can move up to full scale trading with mini lots or regular lots. Anyone who is not willing to demo trade is not serious about forex trading or managing their risks. Remember that forex demo account trades have zero risk.

Set And Move Stop Orders

To further reduce risk always trade with a stop. If you open a live trade with a -30 pip stop order, that is your maximum risk. As the trade proceeds in the direction of the momentum or trend you can move your stop to breakeven, which reduces your risk to zero. Live trades only have risk until you move your stop to break even. When you move your stop to breakeven you can scale out some of your profitable lots to increase your account equity.

In the above example you sell a particular pair and as the pair continues lower you move your stop to breakeven and scale out lots, eliminating risk and capturing some profit.

Forex Risk Management, Risk Capital

Risk capital is defined as 5% of your net liquid assets not counting possessions like houses or cars. If you have $100,000 in a liquid cash account, money market funds or an IRA account in mutual funds that can be easily liquidated, then your risk capital is $5,000. You should not open a trading account for any amount larger than this. If you do you are taking additional risk and breaking one of the first rules that financial advisers and brokers suggest. The good news is that you would likely never open an account this large anyway due to the forex market being leveraged in retail accounts. Trading at 50:1 leverage or much higher to trade the foreign exchange means you need less capital to start. The leverage allows you to get started with a smaller amount of money, and this is one of the reasons the forex is accessible to so many people.

Another great way to control risk is not to use your money at all. There are plenty of companies and firms that will provide live trading capital to fund your forex trading account. All you have to do is be a skilled forex trader and you can reduce risk to near zero on live trading using their capital.

Forex Risk Management, Improve Your Money Management Ratio

The basic concept of money management is that you always risk less than you may possibly make on any trade, which is a great starting point in any forex risk management program. For example, if you enter a trade with a 30 pip stop order, and you estimate that you can make 90 pips on the trade, you are at +3:1 money management ratio (3 to 1 positive) which is very good. Traders falsely believe that money management is only related to setting stop orders. This is true, however, with the proper risk to reward ratio and money management you can be profitable on half of your trades and still build ongoing profits.

Risk reward ratio is the amount of pips you expect to make divided by your initial stop for each individual trade entry. So if you expect to make 100 pips on a trade and have a 25 pip initial stop your risk reward ratio is 4 to 1 positive which is very good. If all of your entries have this ratio, even with 50% accuracy you can build strong ongoing profits, week after week. If you scalp the forex market you will likely fail, because the math simply does not add up based on the number of pips you expect to make being too low. So higher risk reward ratios lower your overall risk and scalping increases your overall risk on every trade entry. Trading with the larger time frames and using support and resistance levels to set price targets will solve most of these risk issues related to having a money management ratio that is too low.

Leverage As A Forex Risk Management Tool

Most forex traders are trading with 50:1 leverage or higher. Leverage can assist with managing risk because on each trade you have to put up less of your own money. Leverage allows traders with less funds to open live trading accounts with smaller amounts of money. Leverage of 50:1 means there is a 2% margin amount, which is the amount you have to put up out of your live funds to trade with. As long as you have an effective trading system and use reasonable stop order and money management procedures, using leverage should not be a problem. But since so many forex traders do not have an effective trading system, demo or live accounts can start to blow up pretty fast. Sometimes leverage attracts traders and they use the leverage as a license to do what they want, instead of imposing rules based forex trading. So instead of blaming the leverage for a lost account, we think it is more accurate to get an effective trading system and to demo trade your way to success.

Forex Trading Risk Management With Position Sizing

Forex risk can be managed with position sizing. Position sizing is the number of lots traded. Traders can start trading live funds with 1 or 2 micro lots, with a stop order to minimize risk. Then gradually increase the number of micro lots up to mini lots over time. As traders gain more experience trading, traders can vary the position size of each individual trade based on market conditions. In a choppy market, a trader does not need to trade at all or can trade fewer lots. In a stable, trending market, the number of lots traded can be increased to take advantage of the stable market condition. If you about to enter a live forex trade and see risk factors, then trade less lots than normal.

Knowledge And Experience Is Good Forex Risk Management

Any knowledge a trader picks up along the way and experience trading with a demo and live account is valuable to all forex traders. As you learn more and gain more experience executing trades, your profits will increase and the number of mistakes willnaturally subside. Learning and practicing trend analysis, locating support and resistance levels, using the forex news calendar, trade management and profit taking, will get you into the pips. Experience counts.

Conclusions About Forex Risk Management - There is a long list of things forex traders can do to eliminate risk from their trading. This article does not cover the entire list but is a great starting point. When you complete this beginners course, you can increase your knowledge about the topics discussed here in our 35 forex lessons, which is an intermediate level forex course for our complete trading system.