Forex Trading Systems, Strategy Comparisons

In this article we will review and compare forex trading systems and choices traders have. We will also evaluate the various systems available and then point out the pros and cons of each type of system. For the purpose of this article a trading system is defined as a complete system. The system should work for any currency pair, the system should allow you to evaluate the entire forex market thoroughly or any pair thoroughly. The system should also provide traders with a method for entering the trades on any pair, and the system should provide guidelines and procedures for managing money and profits to the next target price or to the exit point.

Evaluation of Forex Trading Systems or Strategies

It is possible for a new forex trader to evaluate forex trading systems they find online. But remember there are hundreds of websites offering automated trading robots and other websites making some pretty outrageous claims about the profits. It is difficult to find a good educational course or trading system, so be careful. Most websites want a lot of money up front to teach you anything at all about the currency market, or for even basic information.

That being said, here are some things to look for when evaluating a currency trading system. First, does the website with the trading system you are evaluating have a complete explanation of the system on the website? Are you able to easily ask questions by email, phone or online meeting, or do all you get is a sales pitch or a form to fill out for opening up a brokerage account? Is the website brand new or has the company offering the system been around several years? Foreign exchange websites come and go quickly. Who is the owner of the website and system?

With most forex websites and systems you have no idea who the people are behind the system, all the website shows is an email address and another sales pitch. Is the trading system logical? When you read the information and details about the trading system is everything well explained and easy to understand. Use commons sense and be a good consumer before buying or subscribing to any trading system or expensive course, ask a lot of questions. When you find a trading system you like, or one that makes sense, then start demo trading that system to evaluate it, to make sure the trading system is right for you.

Forex Trading Systems - Scalping with Technical Indicators

Almost every forex trader is scalping the EUR/USD or just a few pairs using some combination of technical indicators. They use different combinations and layers of off-the-shelf technical indicators (Fibonacci, stochastic, RSI, etc). These same traders lose money and continuously default to the smaller time frames. This has been going on for 20 years and the traders who use these indicators complain that currency trading is risky. It has been proven that all of these indicators are 100% useless. These traders need to quickly move on to evaluate another types of forex trading systems, which use obvious logic. Most forex traders cannot even explain what these indicators do and why they use these layers of indicators on their screen. Most traders believe it is okay to do this because that is what other traders do on lots of prominent websites. Traders who do this are lost and will never succeed unless they move on quickly.

Random Instrument and Time Frame

This method is trading a random time on a random instrument or pair and just pushing the buy and sell button while guessing. Many people do this and this is gambling.

Forex Trading Systems - Fundamental Analysis

Fundamental analysis has value to forex traders, and we agree that fundamental analysis can be part of a successful forex trading system. If an individual country or region is raising interest rates that currency is likely to strengthen, so this basic information will assist forex traders. Logically, if a country or regional currency is raising interest rates you would like to buy that currency, and traders could favor this. So this is a pro for using fundamentals. But you cannot trade on fundamentals alone because you can have periods of large draw down on any leveraged trade and your account could get wiped out. Fundamentals can be part of any good trading system. Traders still need more exact entry points into each trade, combined with stop orders. No fundamental trading system without a way to enter trades and manage them is a flaw and a big con. We have written an article about forex fundamental analysis for more advanced information on this topic.

Other Forex Trading Systems

There are many other types of forex trading systems, most of which make almost no sense or are so completely ineffective you shouldn't even bother with them. Martingale systems, hedging systems, hybrid systems which are combinations of technical indicators with catchy "marketing" names, basket trading systems, automated robots, statistical systems, social trading systems, news trading, etc., etc. There will be a lot of pain and wasted time on these websites reviewing and testing these types of systems. And, unfortunately, none of them really meet the definition of a compete trading system.

Trend Following With Confirmed Entry Points

These type of forex trading systems are extremely rare, and it is what we use at Forexearlywarning. We trade with the trends of the forex market on the higher time frames. We also look for new trend that are starting so we can ride the trend cycles. We prepare trading plans daily across 8 currencies and a total of 28 pairs using multiple time frame analysis. Our emphasis is on individual currency analysis, not indicators.

The trading plans we prepare are for pairs that are trending or are building new trends. We use the news calendar and various professional alert systems to notify us of when trades might be imminent. We also validate all trade entry points using The Forex Heatmap®, which uses individual currency strength signals. We employ money management techniques like setting and moving stops along with scaling out lots on profitable trades. We also look for price targets with widely accepted forex support and resistance techniques. Combined with other factors like the forex economic news calendar and always having a trading plan in hand, it is a complete and logical trading system. Surprisingly, very few traders are trend followers or understand multiple time frames. The number of pros of using a system like this are large in number and there are no cons.

Here is a simple strategy: if the EUR is weak on all pairs and the AUD or JPY is strong on all pairs the forex market is telling you to sell the EUR/AUD or EUR/JPY. This is very simple and it works. This is one of the things we do at Forexearlywarning. Traders say that they want things to be simple but they routinely make trading incredibly complicated. Choose a simple system that is logical even for the non-trader to understand. We also trade significant breakouts of support and resistance with verification from The Forex Heatmap®, another simple trade entry system that works.

.jpg)

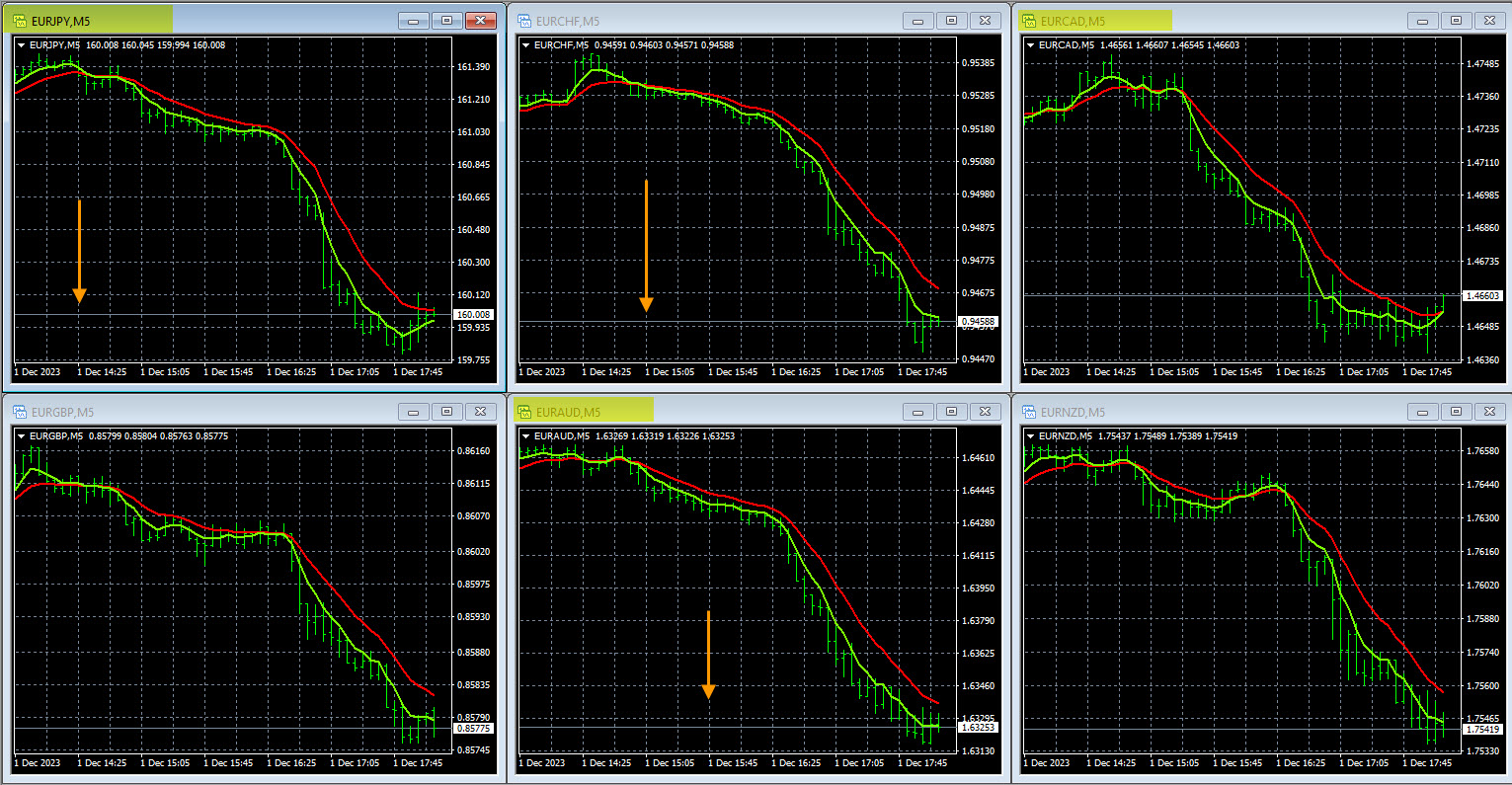

Right click on the charts and open in a new tab. The EUR pairs dropped hundreds of pips in one trading session.

The forex market market itself is the best indicator for traders and it always will be. We analyze the entire market daily at Forexearlywarning to determine the trends of the market, then perform similar analysis at the point of trade entry. Our techniques are logical and straightforward.

Developing Your Own Forex Trading Systems

Developing your own trading system has been tried by thousands of traders, resulting in many thousands of systems now available along with thousands of failures. This is evident on many of the more popular forex websites and trading forums. 99% of these systems are based on failed technical indicators. The reason that these thousands of systems do not work is that they are all fundamentally flawed by being based on faulty technical indicators, and the infinite possible number of combinations of these indicators.

There are currently plenty of forex trading systems and strategies available to choose from. One issue is that there are way too many systems available. The second issue is that of the thousands of systems that are available, none of them make any sense at first glance, just pictures on a website. Finding a system that is simple, that can be understood by anyone, is easily explained, as well as powerful for making pips is rare to non-existent. We believe the Forexearlywarning trading system is head and shoulders above all of them.

Why Do So Many Currency Traders Fail?

Forex traders fail because they do not have a trading system that works. Or they have no trading system at all, they have no trading plan, they have no market analysis skills, they have no money management techniques, quite a list! Also there are psychological issues and barriers, simple greed and refusing to demo trade, and emotional decisions versus logical trading decisions also contribute to the failure of most currency traders. Having a logical trading system like the Forexearlywarning trading system is the beginning of the cure to these failures.