Instructions For Using Our Trading Plans

PLEASE NOTE: This lesson is being re-written now to reflect our new community trading plans which will be launched on April 22 at 1200 noon EST.

These are the instructions for using our trend based trading plans. Our trading plans are simple and unabiguous and they will tell you what pairs are trending, price alert points for short term and long term breakouts, and target support and resistance levels, when visible Our plans are written for the 8 most liquid currencies and 28 pairs total, gold and cryptocurrencies. Always know what pairs are trending on the higher time frames.

Retrieving The Trading Plans

All clients can login to our website, retrieve and view the trading plans, access The Forex Heatmap®, live heatmap alerts and scanner system anytime. Just login to the members area with your username (email address), and password for complete access. Remember that you can login from only one device or browser at a time, use the "logout" button in the members area if you want to monitor the market from a second device.

These trading plans are "Community Trading Plans". This means that any subscriber can post their own trading plans for 28 forex pairs, gold or cryptocurrencies. The plans posted by Forexearlywarning staff will be annotated with FEW in the signature. Each trading plan can also be printed out using browser commands, just go to the trading plans area or any page, and right click on the browser to expose the browser print command.

Trading Plan Frequency

Trading plans can be posted by any subscriber throughout the day at any time. We suggest evaluating the market later in the Asian session so currency strengh, trends and consolidations cycles are more clear. Forexearlywarning will post their plans twice daily starting on Sunday night USA time. Evening USA time trading plans will be reviewed and issued by Forexearlywarning around 900-1000 PM Eastern Standard Time (New York) Sunday through Thursday night. Post market/main session trading plans are issued at roughly 1130-1200 EST daily on Monday through Friday. Trading plans are issued 10 times per week starting Sunday evening, USA time, unless there is a USA/USD bank holiday, like Christmas or Labor Day. All trading plans posted by Forexearlywarning or any client has a time and date stamp. The most recent trading plans are near the top of the page and in reverse chronological order.

New Trading Plan Notifications

When a new trading plan is issued by Forexearlywarning, we send out new trading plan notifications in real time on our twitter feed. The twitter notifications can be routed to your smartphone or Ipad by downloading the twitter application. Or just put the web address for our twitter feed into any smart device. Check our twitter feed closely as we actively post content and notifications there week after week. You can follow us on twitter @forexearly.

Trading Plan Contents

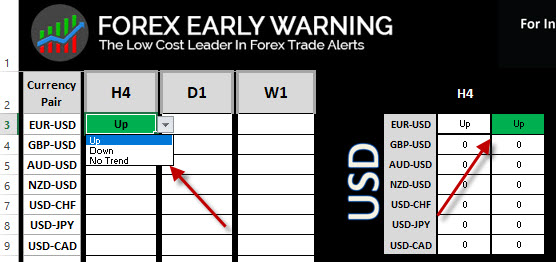

The trading plans will tell you what pairs are trending, oscillating/ranging, or a new trend is in place or forming. Trading plans are based on the H4 time frame or larger. We will also describe the behavior of the pair and as well as the overall market, i.e choppy, trending. We discuss the pairs in parallel and inverse groups, for example all JPY pairs are discussed together, all USD pairs are discussed as a group, etc. The plans are designed for the main forex trading session, but after you get some experience with our system the same principles can be applied to the certain Asian session trades. We also put support and resistance price targets in each trading plans, pair by pair, when they can be identified or estimated.

Community Trading Plans Functionalities: Anyone can post their own trading plan any time of day for any forex pair, currency, gold XAU or cryptocurrency. This allows our more experienced clients to contribute our trading plans, we have many clients with more than 10 years experience analyzing the markets. Forexearlywarning has full administration rights over the plans posted by our members. We will also be posting our plans side by side with the more experienced clients.

Alert Systems

Nearly all trading plans have price alert points on certain pairs for possible breakout points notification. When the price alerts are breached this is not an entry point, all entry points must be checked and have consistent signals from The Forex Heatmap® live signalling system. If the heatmap indicates that you should not enter the trade just reset the alarm slightly higher or lower and check the pair and the market condition again later when the adjusted price alarm hits. So make sure you know how to set audible price alerts on your trading platform. Metatrader and other platforms have the audible price alert functionalities built in to the platforms.

The audible price alerts will cause your Metatrader trading platform to make audible sounds to alert you when pairs might be moving or breaking out. The audible price alerts can also be delivered to your cell phone via email, please contact your broker for details or to see if they have this function available. For instructions on setting forex price alerts see our short video on how to do this.

You can also monitor all of our professional alert systems like the forex news calendar, our desktop scanner tool, or mobile or desktop push alerts apps. Review this complete lesson about all of our forex alert systems, and you can monitor the market for movement like a professional trader.

Trend Indicators

All clients should set up the free forex trend indicators to track the trends of the market, follow our trend based trading plans, and for conducting their own market analysis across multiple time frames. When checking the trend indicators focus on the larger time frames, H4 or larger, on all 28 pairs we follow. Traders can use the smaller time frames, along with support and resistance and The Forex Heatmap® to verify your trade entries.

An established trend is when the red and green lines are separated and pointed up (or down) with a good angle on the H4 and larger time frames on the free trend indicators. Open red and green lines point up for up trends and down for down trends and the trend is valid for that particular time frame. In our trading plans we keep traders informed as to when new trends are forming on the larger time frames. Most of your trade entries will occur in the main trading session until you are completely familiar with the system, then, a small amount of additional trades will be possible in the Asian session. Please read lesson 14 to learn more about the trading sessions.

Forexearlywarning uses multiple time frame analysis of up to 15 time frames on 28 currency pairs for trading plan development. We analyze the trend indicators and pairs according to all 8 currency parallel and inverse analysis currency groups, i.e., USD pairs are analyzed together as a group, then all of the EUR pairs, then all of the JPY pairs, etc.

We also advise all forex traders to use the metatrader profiles. Using this chart setup you can view 7 pairs at a time with one common currency to match the heatmap configurations for your trade entry management. Navigate quickly through 7 charts at a time on any time frame using the keyboard hotkeys. This fantastic chart setup is a lifetime chart setup, so please heed our advice and set up your charts this way. You will not regret it!

Role of the time frames: Remember that you use the smaller time frames and consistent heatmap signals to guide your trade entries into the trends that exist on the H4 time frame and larger. Check out these example trade entries for more clarity on what a good trade entry looks like.

.jpg)

Forex Economic News Calendar

All of our trading plans reference the strong news drivers on the economic news calendar. Be sure to check the forex news calendar for the upcoming trading session. Economic news can drive price movement. Here is one world economic calendar we like and reference in each trading plan, or use the news calender at Dailyfx. Strong news drivers are denoted with icons for all 8 currencies we track. For more detailed information on how world economic news impacts your trading you can review lesson 5 in our 35 forex lessons.

.jpg)

The Forex Heatmap®

All subscribers have access to The Forex Heatmap® for live signals and trade entry verification, including a fully redundant server based backup system. The heatmap should be used to verify ALL trade entries. Traders can review its proper use and associated lessons before you enter your first demo trade. Learning resources and example trade entry signals for the heatmap are part of our educational resources. Combine the heatmap with our professional alert systems and you will always be informed as to when then the market is moving. Never enter a trade without full heatmap confirmation for maximum safety on trade entries.

Outages and Backup Plan

If one of the heatmap servers goes down there is a backup heatmap in the members area. If our website goes down for any length of time, you can send us a courtesy email to let us know, however this website on cloud based servers and our uptime is close to 100%. In the case of an outage we can keep you updated on our twitter feed as to when the website will be back up. We can also post our daily trading plans to twitter, and set up a temporary link to The Forex Heatmap® on our twitter feed. So all paid clients should set up a free twitter account and follow us at @forexearly so you dont miss any pips. Our clients will always have complete and redundant backup systems for all critical systems.

Non Trending Pairs, But More Pips !

Sometime we issue our trading plans but those pairs consolidate the next day and other non trending pairs start moving based on news drivers or unexpected news. Pairs going sideways or non trending can take on a new direction quickly. Thesenew movements or breakouts can produce alot of pips and new trends could form from these movements. We refer to these trades as supplemental trades. Read this documentation and make additional pips on supplemental trades or trade that occur in the main session that may not have been visible in the previous days planning process.

Learn To Write Your Own Trading Plans

If you fill out our forex market analysis spreadsheet daily for 8 currencies and review support and resistance levels, you can learn the life time skill of building your own trading plans. After some practice you will get much better. We invite all traders to learn this valuable skill to apply to your trading and to follow along with our trading plans. Compare your trading plans to ours and track your progress to becoming a great forex analyst!